This page includes some useful and easily editable payslip templates and formats. All these templates and formats are available in Microsoft Word and Excel below. One can simply choose to download, edit, and use any of the given payslip templates and formats. But first of all, it is important to know what payslip actually is and why it is used.

What is a Payslip?

A payslip is basically a document that the employer issues to the employee at the time of paying the employee’s salary or wage. A payslip is also known as a salary slip or salary statement. Such a slip actually includes all the details and information related to the payment made to the employee.

Every business or any other organization, irrespective of its size or nature of its operations, hires employees. Of course, such employees are required to be paid as per the employment agreement’s terms and conditions. It is the duty of the employer to record the payments made to an employee. For that purpose, a payslip or salary slip is used.

How to Use the Payslip Templates?

If you don’t know how to create a professional payslip, the pre-formatted payslip templates and samples can be of great help to you. Using these templates will save you a lot of time and effort and will make the work easier for you. All you have to do is to download any of the suitable templates given below, edit their contents, and use them as per your requirements.

You can customize and change the given payslip templates however you want to. Just hit the download button and the template will be yours to use for free.

Payslip Templates & Formats in MS WORD are Given Below

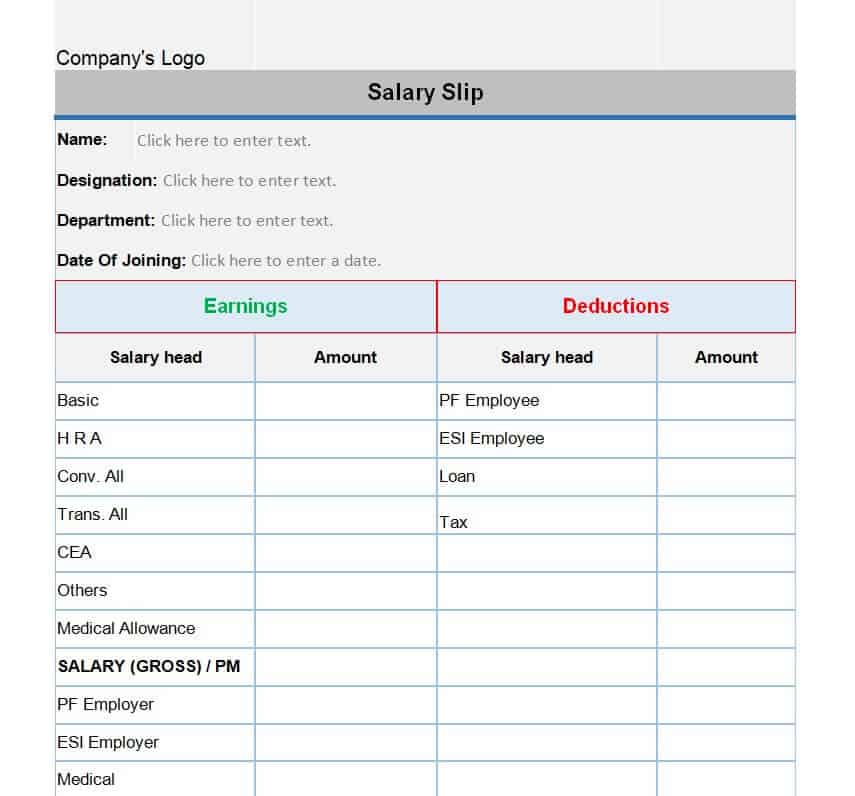

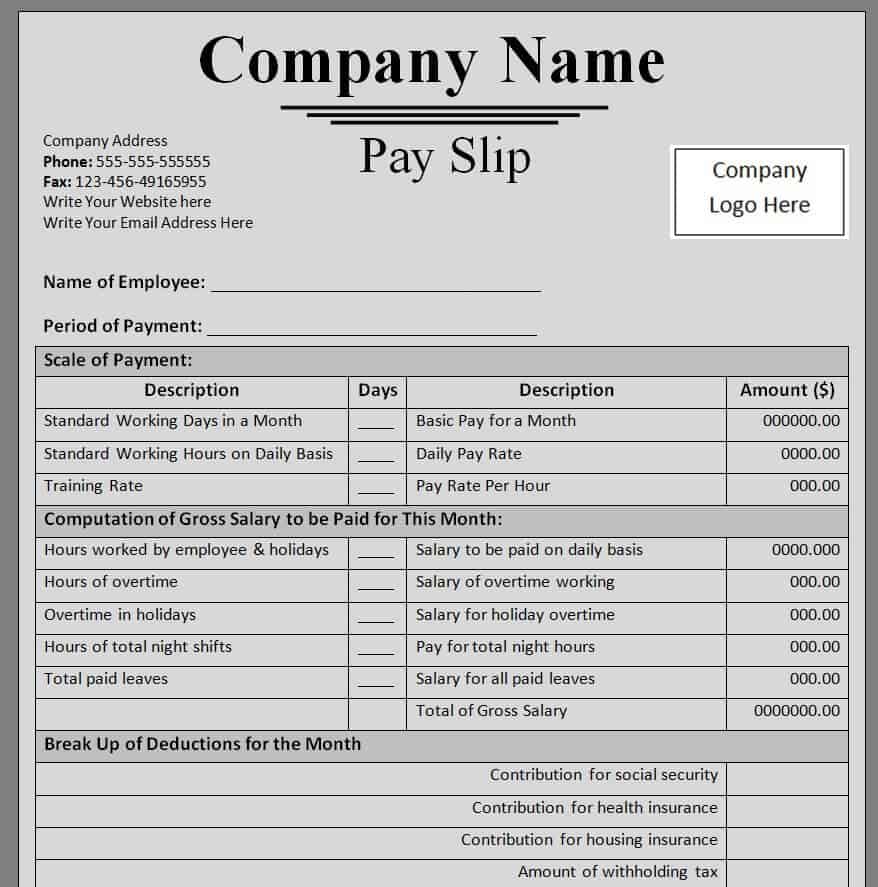

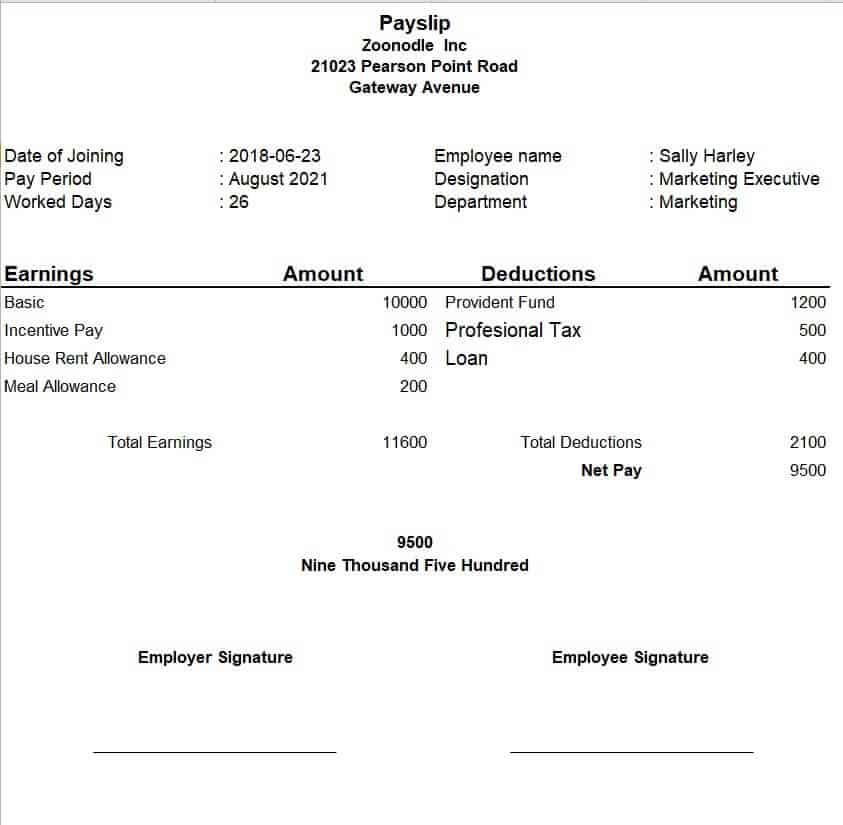

Employee Payslip Template

File Size: 13 KB

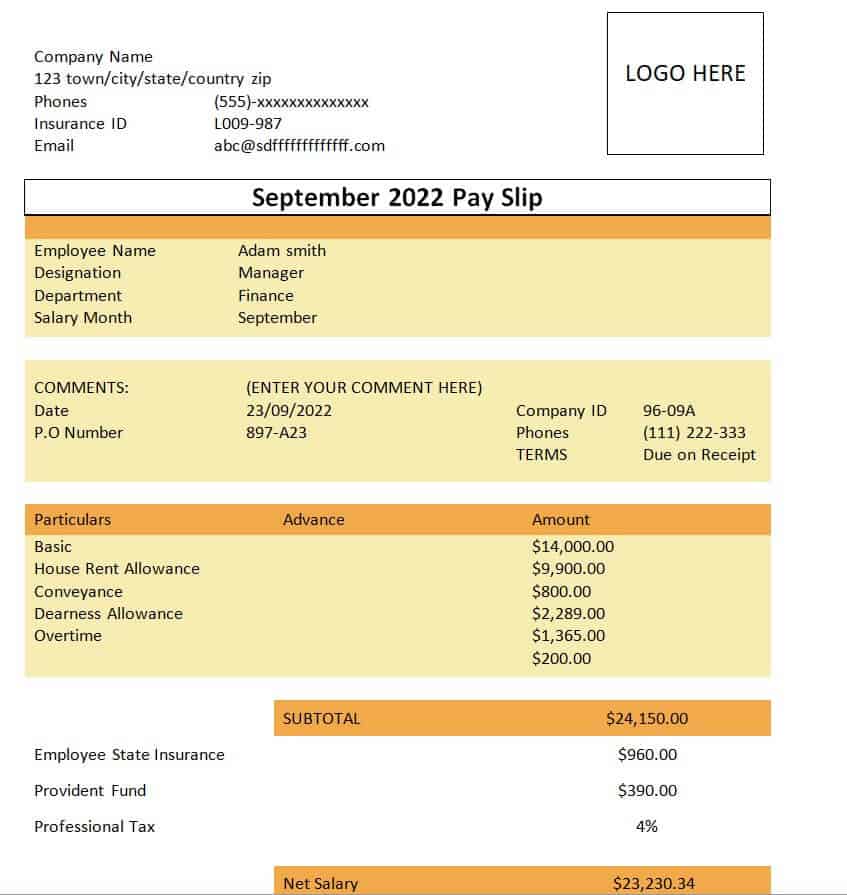

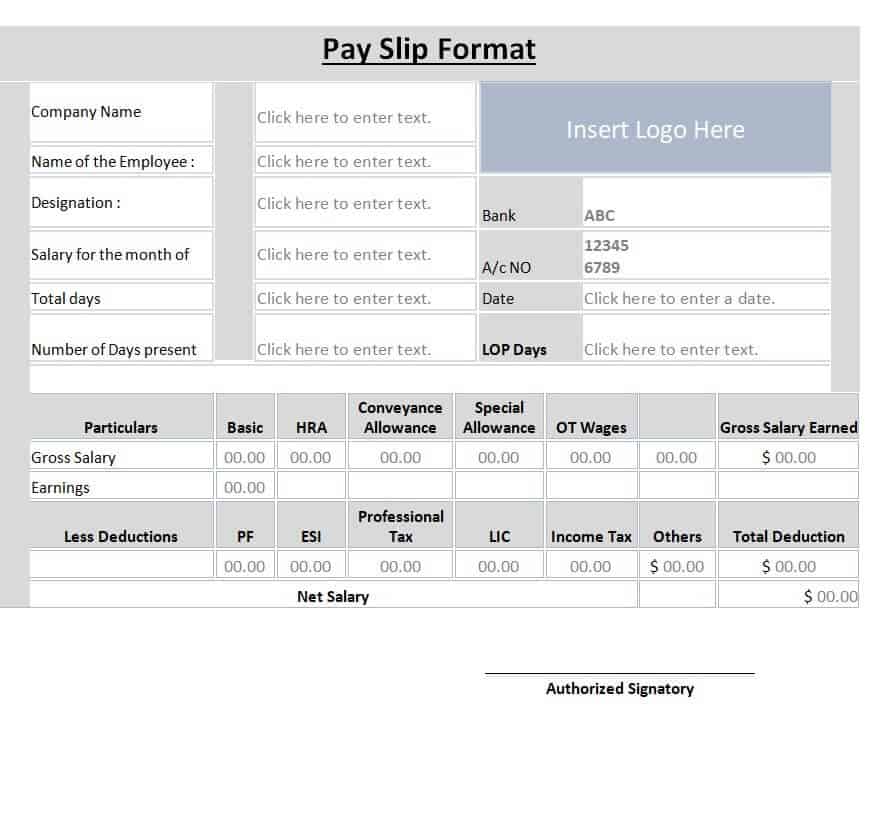

Professional Payslip Format

File Size: 15 KB

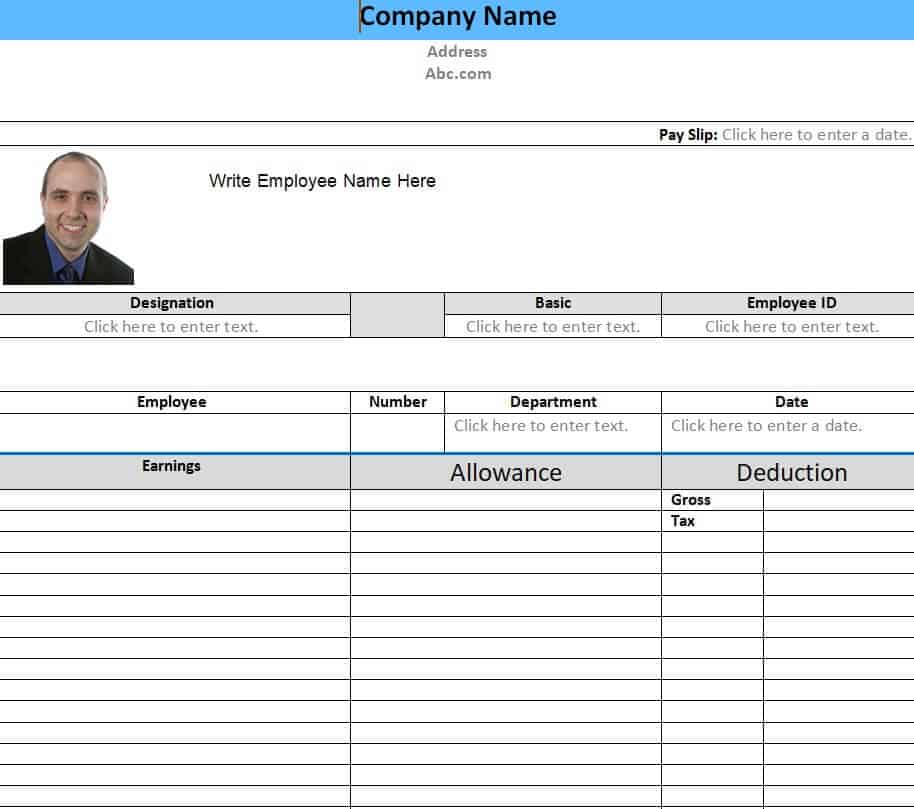

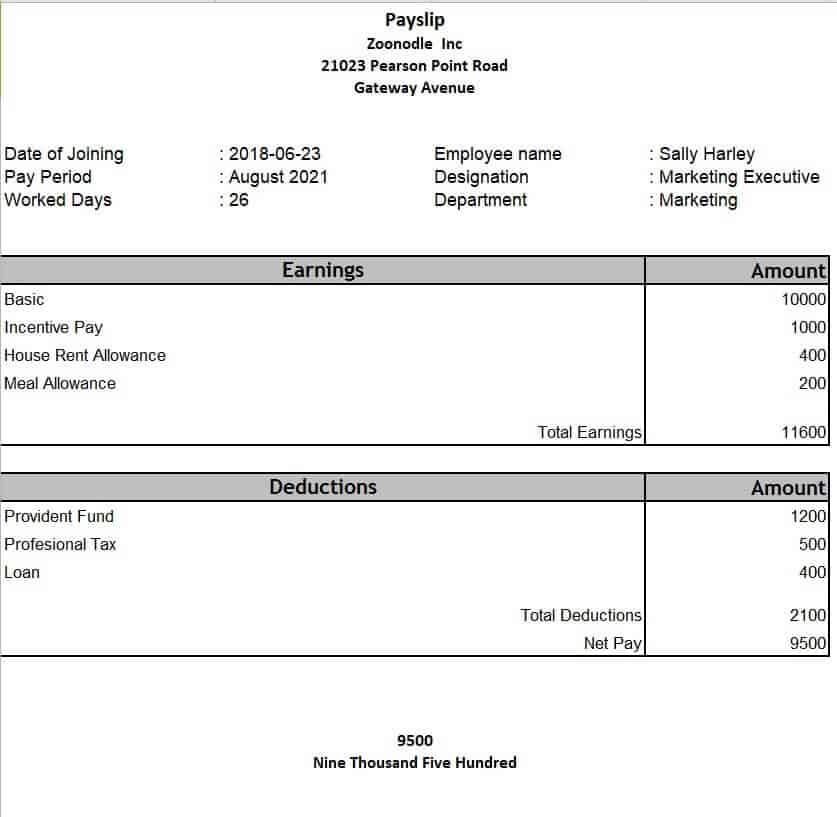

Sample Payslip Template

File Size: 09 KB

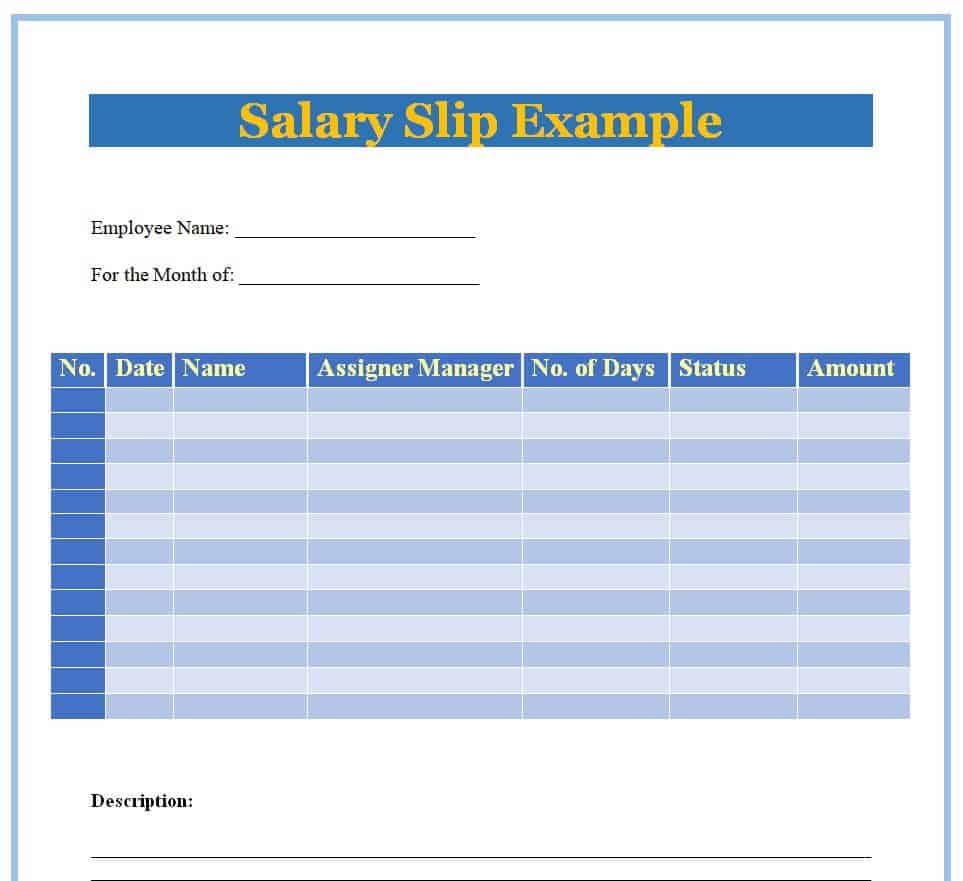

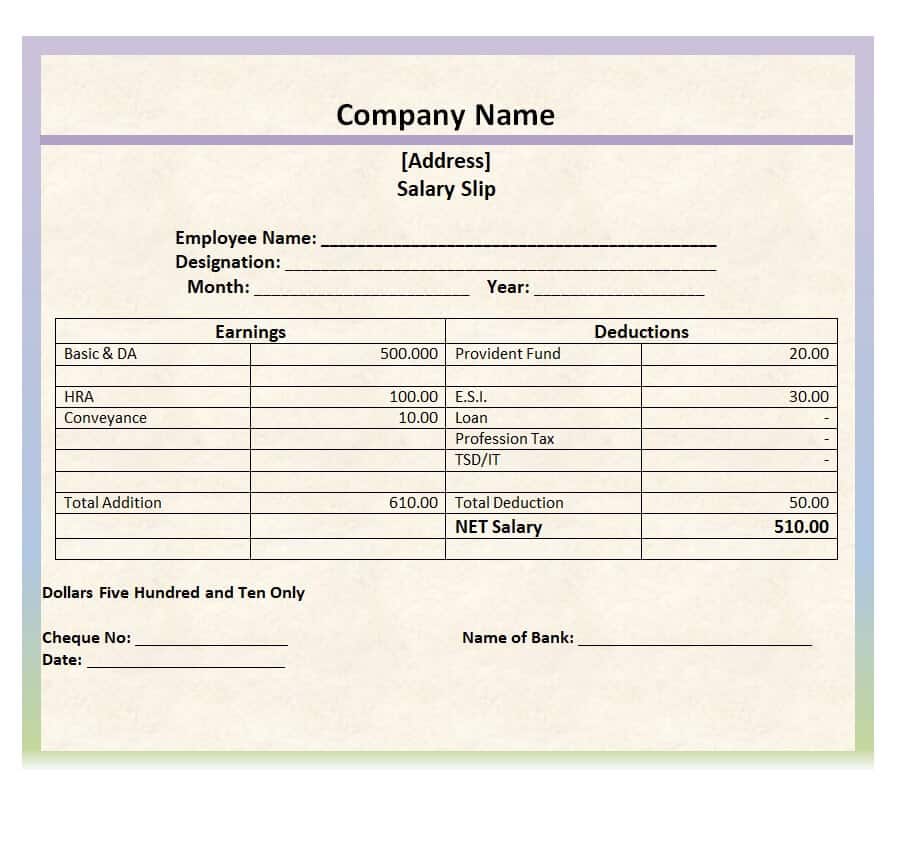

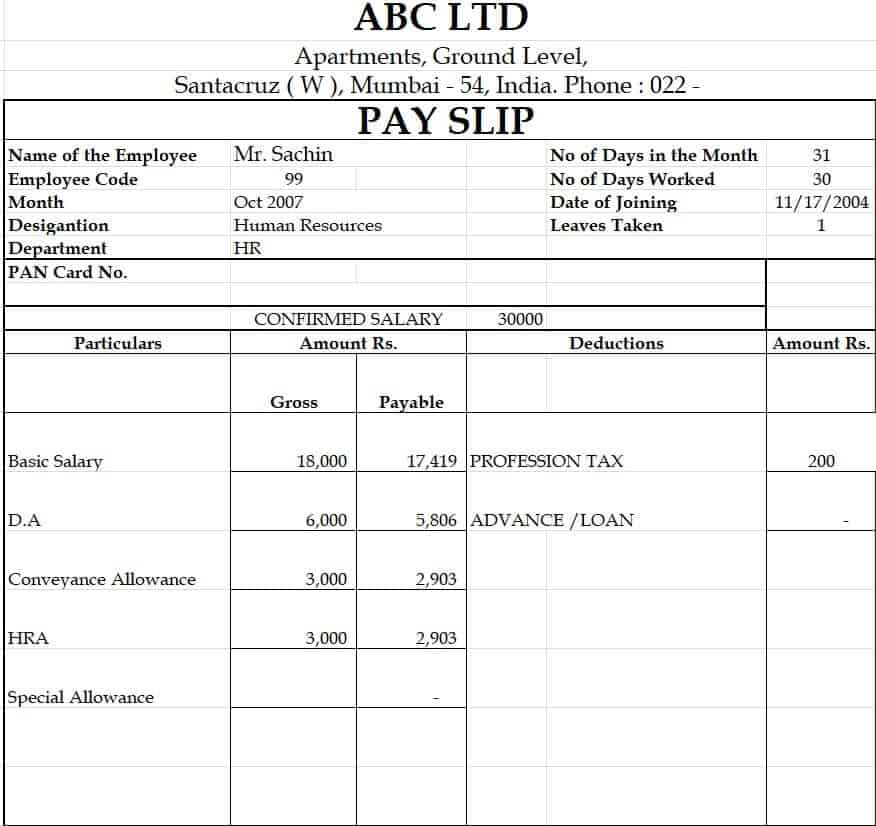

Fillable Salary Slip Example

File Size: 15 KB

Company’s Payslip Template WORD

File Size: 10 KB

Monthly Salary Slip Statememt Template

File Size: 35 KB

Official Payslip Template in MS Word

File Size: 53 KB

Simple Business Payslip Template

File Size: 12 KB

Formal Salary Slip Doc Format

File Size: 22 KB

Company’s Monthly Payslip Template

File Size: 08 KB

Free Editable Payslip Template

File Size: 73 KB

Company’s Sample Salary Slip Example

File Size: 27 KB

Formal Pay Slip Template

File Size: 16 KB

Free Fillable Payslip Format Word

File Size: 40 KB

Payslip Templates & Formats in MS EXCEL are Given Below

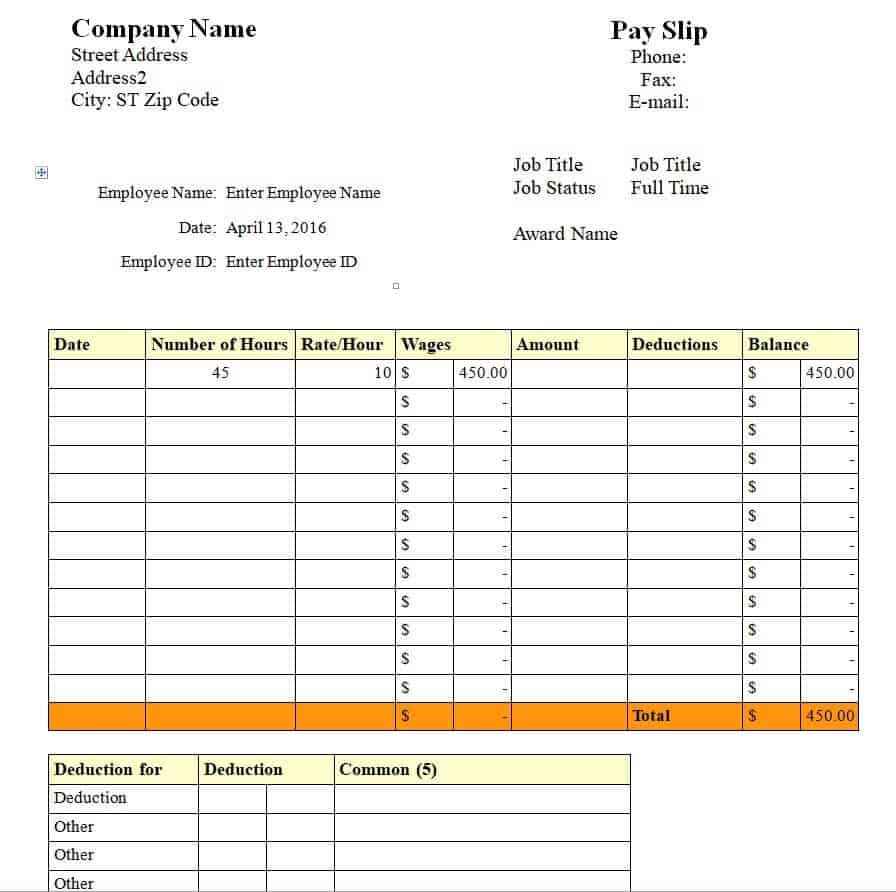

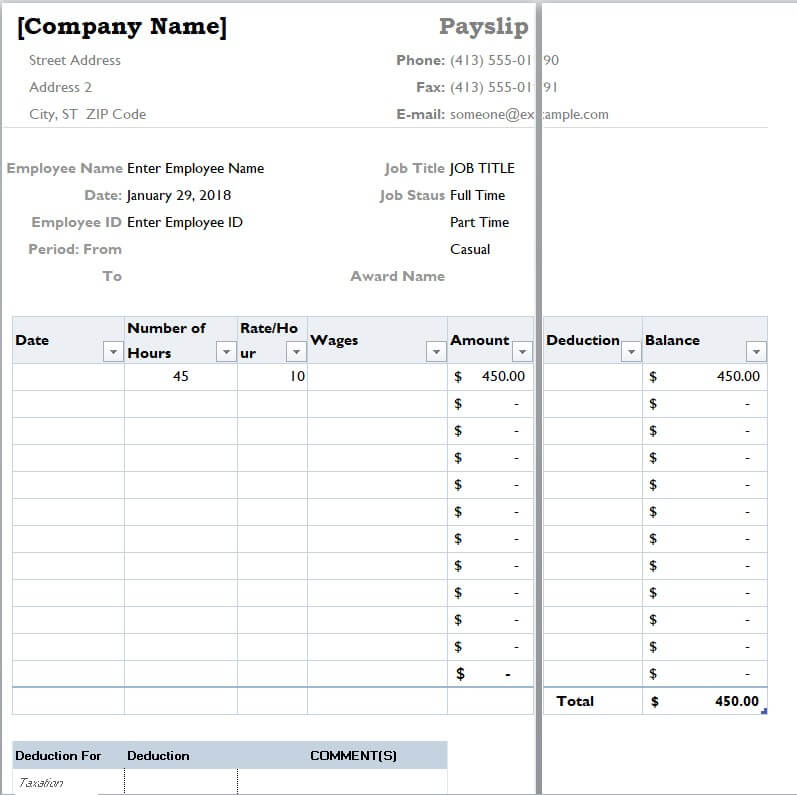

Small Business Payslip Template

File Size: 11 KB

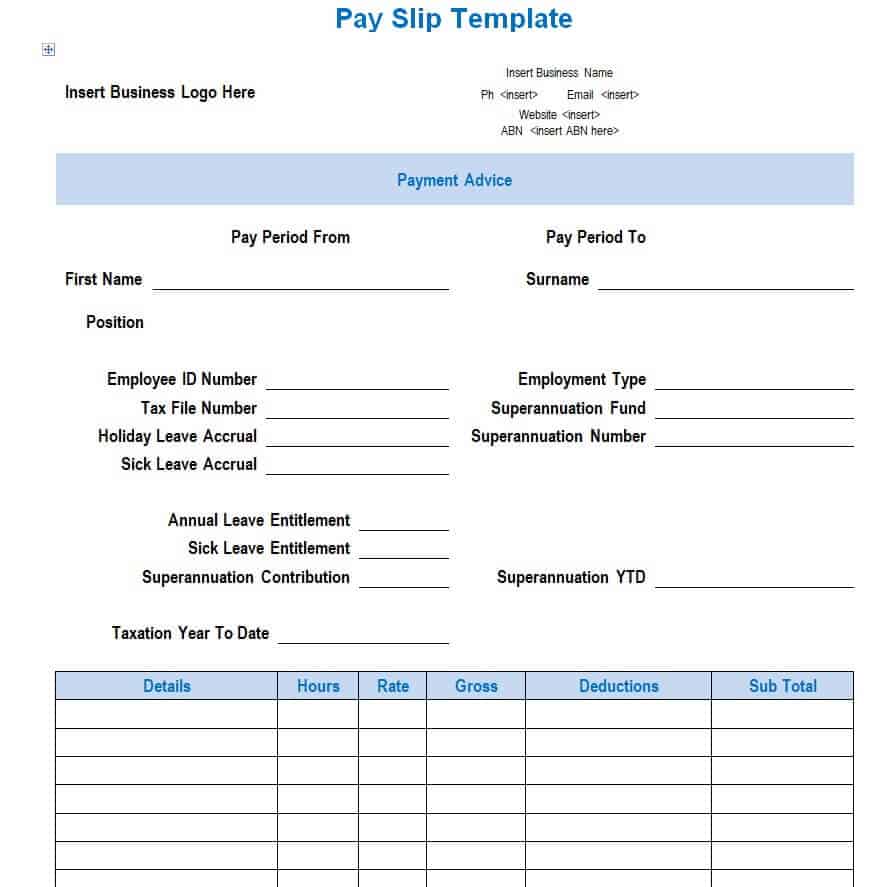

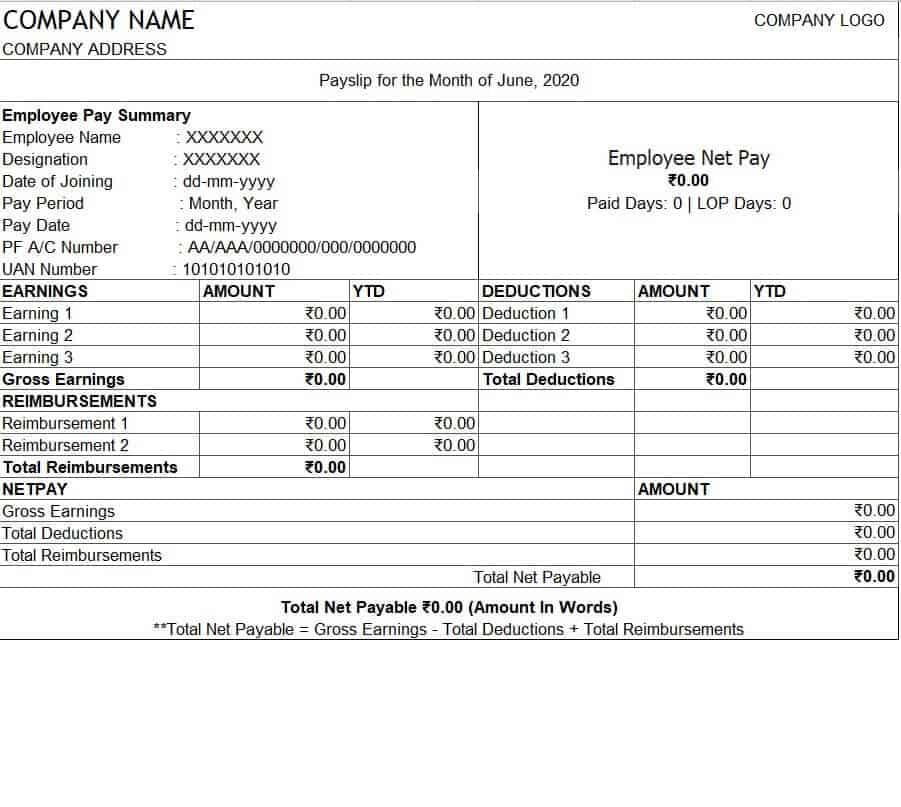

Sample Payslip Template in MS Excel

File Size: 20 KB

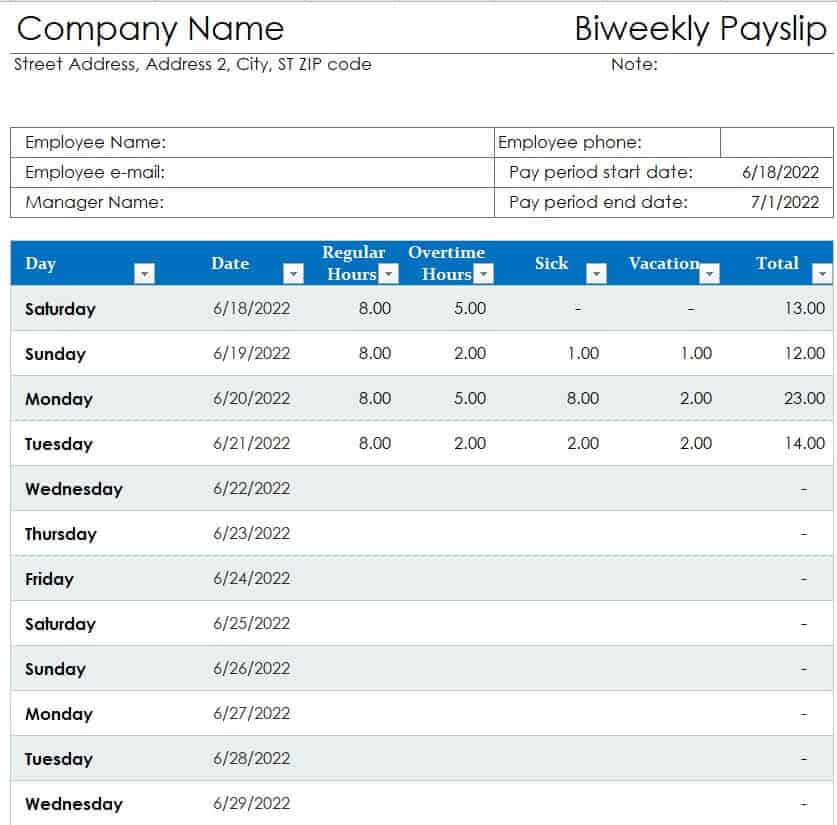

Company’s Biweekly Payslip Template

File Size: 14 KB

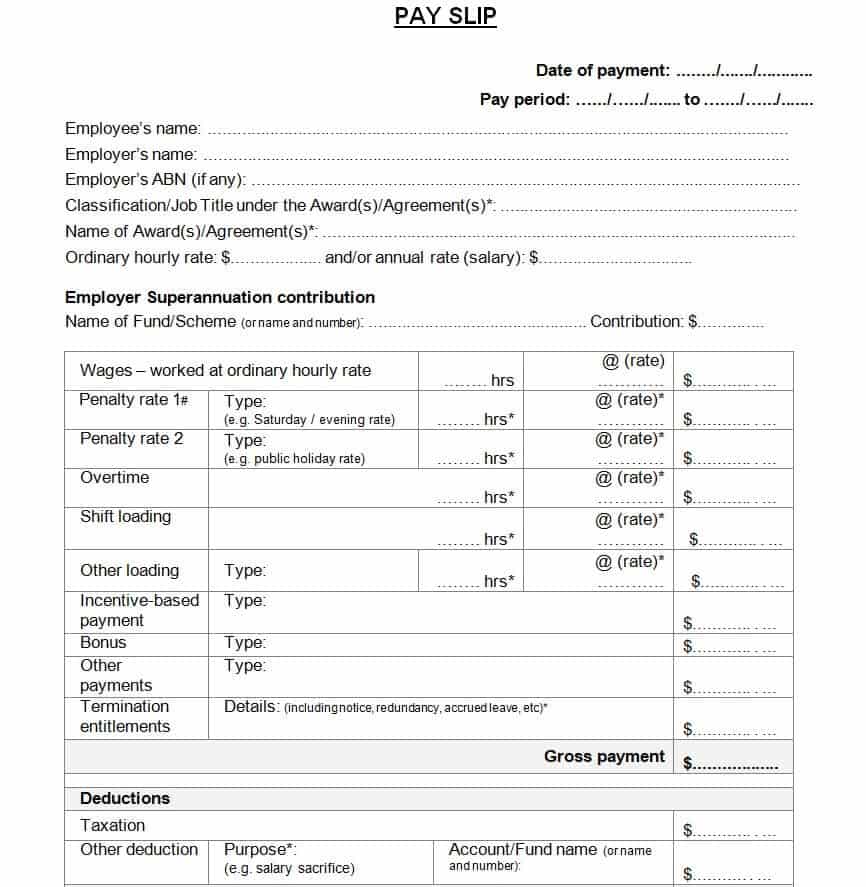

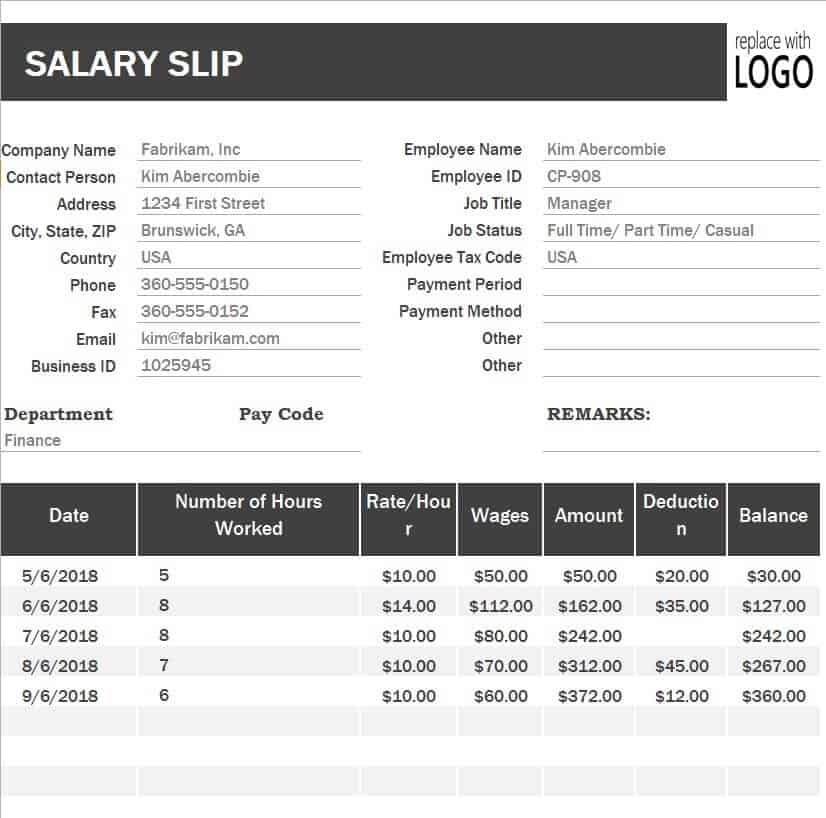

Professional Salary Slip Template

File Size: 18 KB

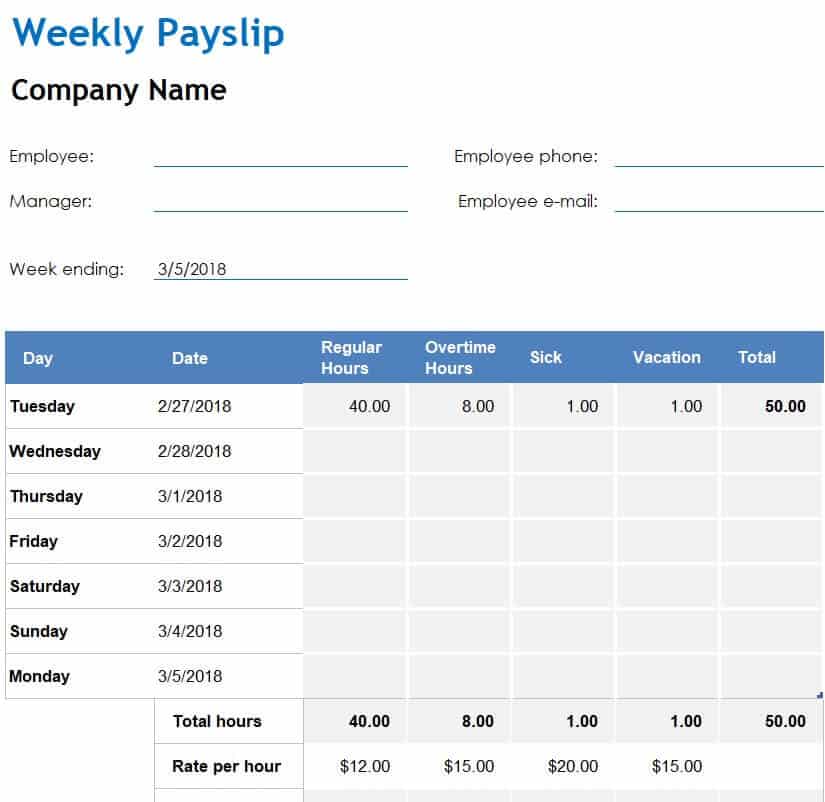

Customizable Weekly Payslip Template

File Size: 16 KB

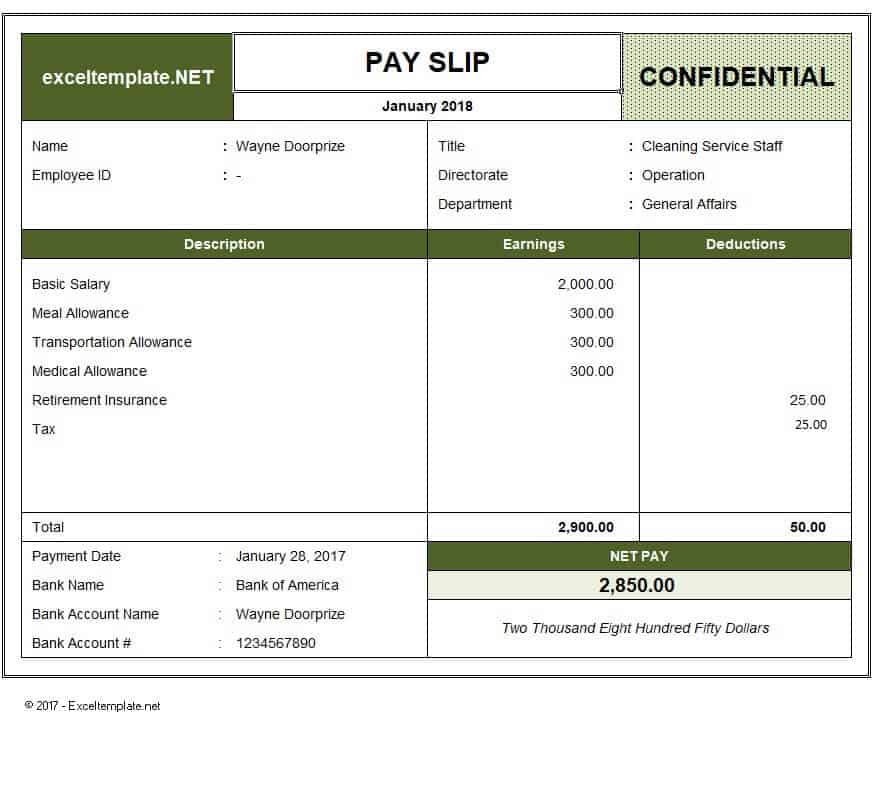

Special Payslip Format Template

File Size: 466 KB

Simple Corporate Payslip Excel Template

File Size: 18 KB

Free Editable Detailed Payslip Template Excel

File Size: 3 KB

Elegant Style Payslip Template

File Size: 10 KB

Example Payslip Template XLSX Format

File Size: 09 KB

How to Create a Payslip from Scratch?

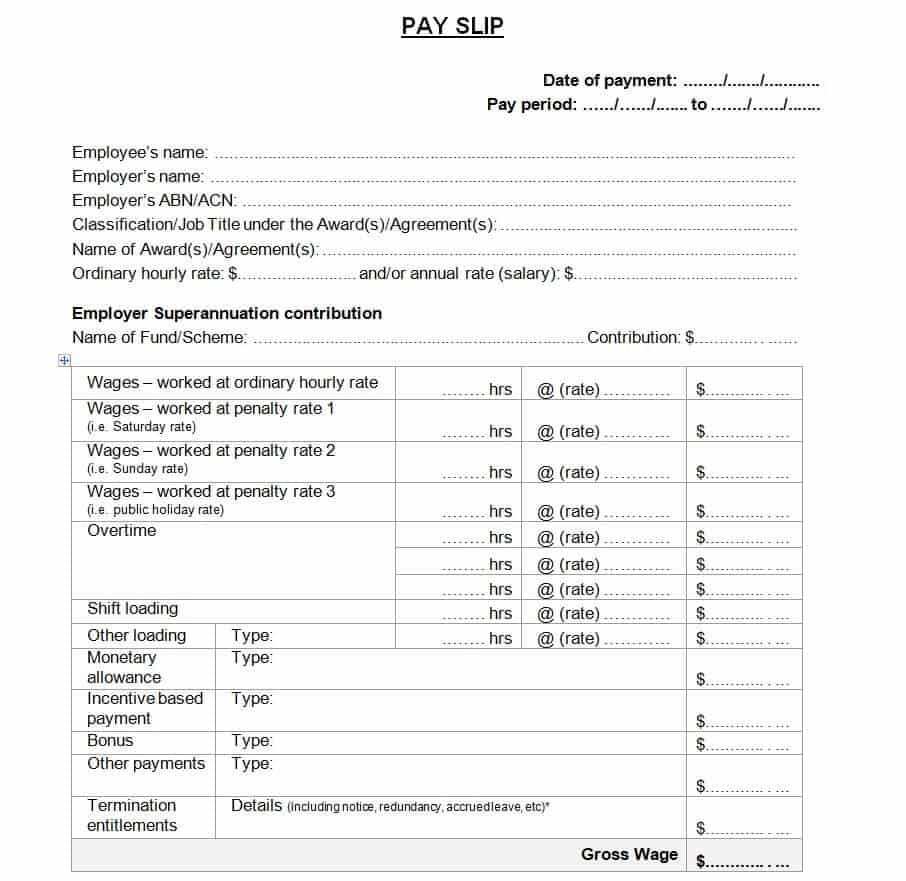

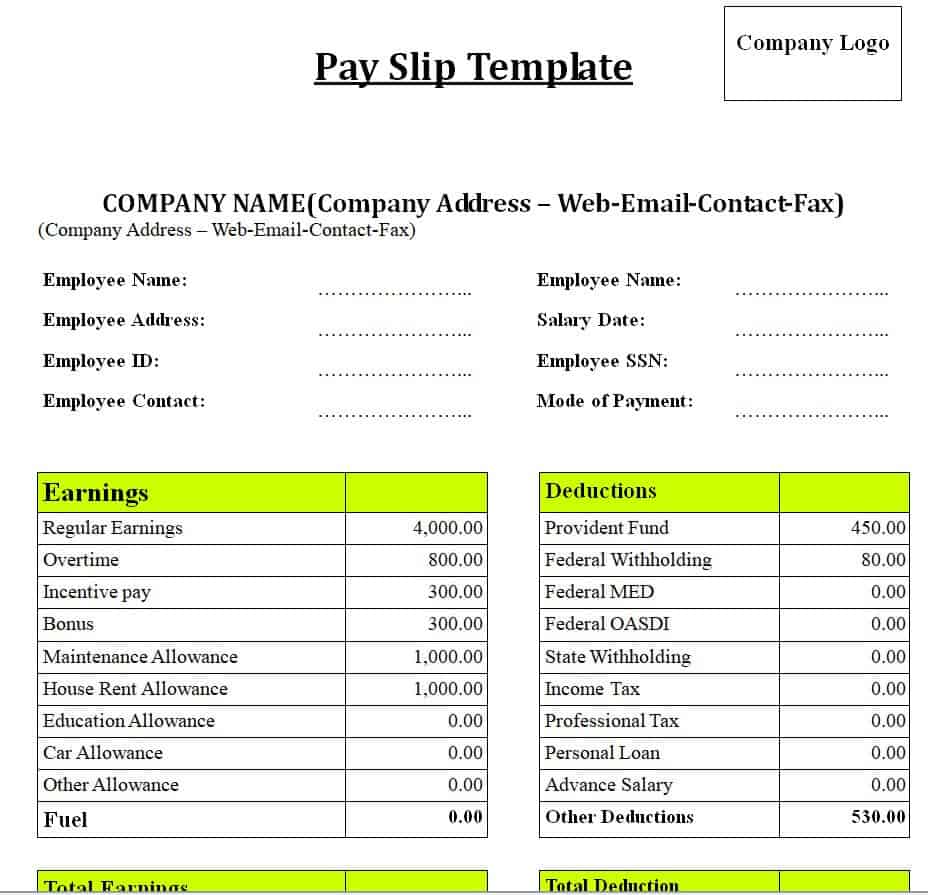

If you intend to create a payslip or salary slip from scratch, then you must keep in mind to use the correct format. Make sure to create one in the Microsoft Word or Excel program. Don’t forget to include all the relevant details in your payslip format. Following are some useful details that you should consider including in your sample payslip document:

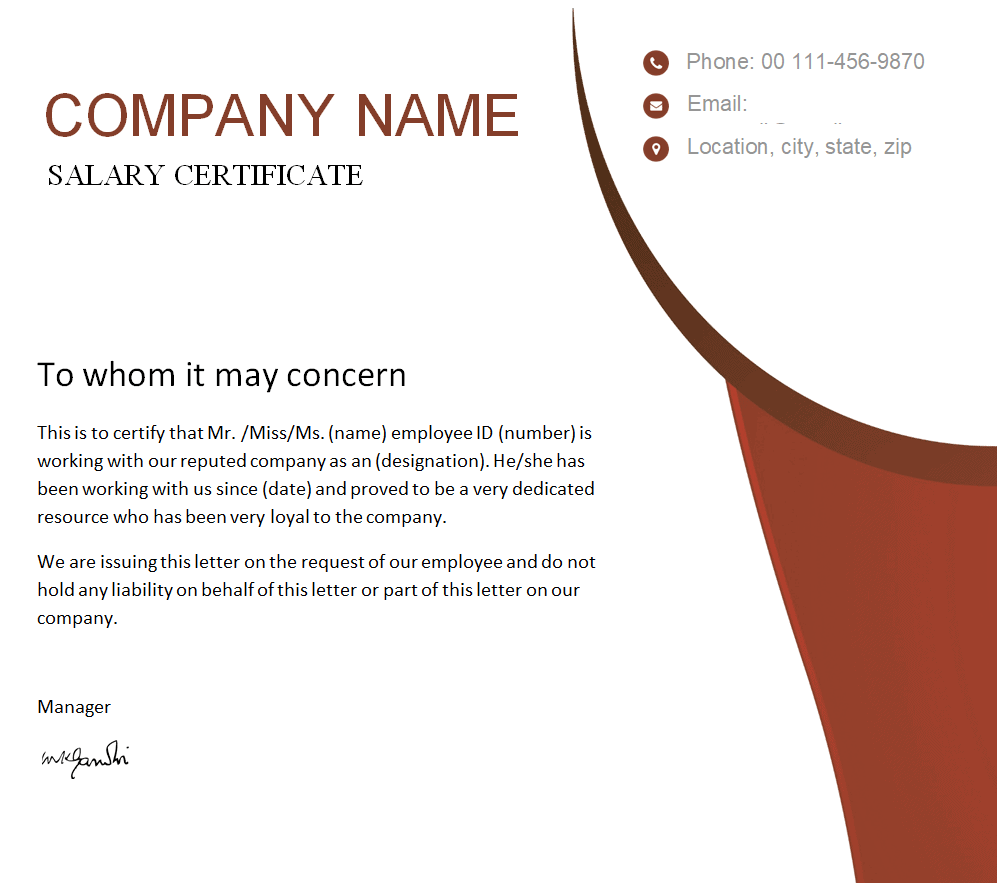

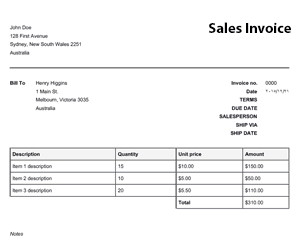

- Organization details like name, address, and logo. This is important so as to make the payslip official and professional.

- Mention the period for which the payslip is actually prepared. Write the start and ending date.

- Details of the employee to whom the payslip is being presented. Details like:

- employee’s name,

- designation,

- residential address,

- contact details,

- employee code, etc.

- Mention the basic amount of the salary.

- Write down the other amounts that are added to the salary like:

- bonuses,

- overtime,

- dividends, etc.

- Include the details of the allowances if any. These details will include the type or nature of the allowance and the amount of that allowance.

- After that, include the details of the insurance of the employee, if there are any.

- The above-mentioned details (basic salary, other amounts, allowances, and insurance) will make up the gross salary. So, mention the amount of gross salary.

- Then include the details of deductions like:

- income tax,

- amount of contribution to the employee’s provident fund, and

- contribution to the employee’s pension fund, etc.

- After that mention the net amount of salary both in numbers and words. The net salary will be written by deducting the amount of the above-mentioned deductions from the gross amount of salary.

- Include the details or particulars of the employer or any other person in charge of the creation and presentation of the payslips. These details will include the person’s name and designation.

- In the end, leave some space for the signatures of the employer or any other person in charge of the creation and presentation of the payslips, and the employee.

Benefits of Using Payslips or Salary slips?

You must be wondering what are the actual benefits of preparing and using a payslip or salary slip. Well, a payslip is quite important both for the employer and the employee. Some amazing benefits of using a payslip are:

- Official payslips can prove to be of great value when obtaining jobs or employee loans in the future.

- A payslip or salary slip can also be presented as a piece of conclusive evidence in case of any legal dispute. A duly signed payslip indicates that the employer has paid and the employee has received the amount mentioned in the payslip.

- Payslips are important in keeping an up-to-date record of business expenses.

- An official payslip helps avoid misunderstandings and confusion at the workplace.

- The issuance of proper professional payslips refrains the employer from facing any kind of penalties or lawsuits.

- Payslips are also important when an employee wants to apply for a mortgage or a bank loan.

- A payslip also indicates the tax records of both the employer and the employee in respect of the employment.

- Payslips are also important in the case of both internal and external audits of an organization.

- The total amount of an employee’s provident fund and pension can be double-checked and cross-verified with the help of a payslip or salary slip.