Whenever you pay your mortgage in full, it is your right to demand the satisfaction of the mortgage form from the mortgagee i.e., the person who lent you the money against your asset. The satisfaction of mortgage form is then signed by both the parties, which indicates that the mortgage is fully paid by the mortgagor i.e., the person who borrowed the money.

What is a Satisfaction of Mortgage Form?

The satisfaction of mortgage form is an official document that indicates that there is no charge or lien on an asset and the borrower has paid his/her mortgage in full to the lender. This document makes it official that certain property or asset is now free of any charge or lien. Once the final payment of the mortgage is made, the mortgagee provides the mortgagor with a satisfaction of mortgage form which includes the signatures of both the parties.

After that, it is also very important to present this signed satisfaction of mortgage form to the notary public so as to get it notarized. As soon as this form gets notarized, it will be delivered to the mortgagor. It will then indicate that the mortgagor has made all the payments in full to the mortgagee and any charge or lien will be lifted from the mortgagor’s property or asset.

In this article, we have provided you with 18+ free satisfaction of mortgage forms that can be quite helpful to you. All these form samples are in Microsoft Word format so that whenever you need to get a satisfaction of mortgage form, you can simply download it, make changes to it, and use it as per your requirements.

Check Sample Satisfaction of Mortgage Forms Below

Basic Satisfaction of Mortgage Form

File Size: 13 KB

Satisfaction of Recorded Mortgage Form

File Size: 3 KB

Official Satisfaction of Mortgage Piece

File Size: 15 KB

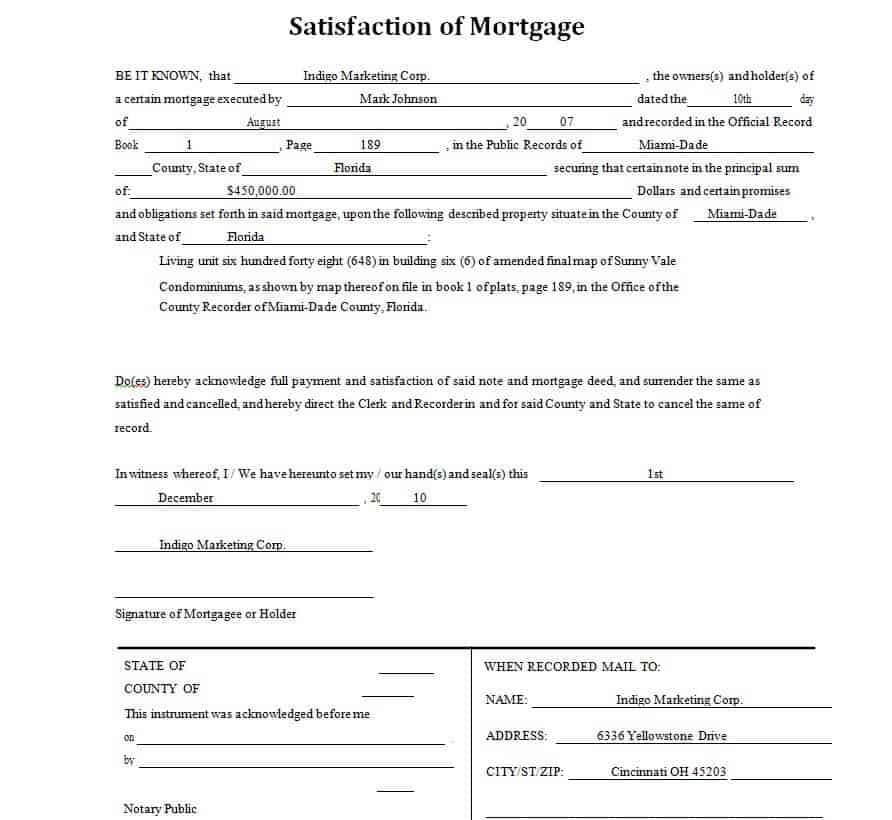

Satisfaction of Mortgage Form Florida

File Size: 6 KB

Blank Satisfaction of Mortgage Form

File Size: 4 KB

Short Satisfaction of Mortgage Form

File Size: 3 KB

Satisfaction of Mortgage Form WORD

File Size: 5 KB

Example Satisfaction of Mortgage Form

File Size: 7 KB

Sample Certification of Satisfaction in DOC Format

File Size: 10 KB

Simple Satisfaction of Mortgage Form

File Size: 9 KB

Details or Information to be Included in a Satisfaction of Mortgage Form

As you can see from the given satisfaction of mortgage form samples and templates that it is not some complex or complicated form. It is a document of a simple nature that is very important to be kept for record purposes. So it is very important that a mortgage satisfaction form must include all the relevant details and information in it. For instance, the following are some basic details that must be included in the satisfaction of mortgage form:

Details of Both the Parties

A mortgage satisfaction form sample must include all the relevant details of both the parties involved i.e., the details of both the borrower and lender. These details can be the full legal names of both the parties, their contact details, and their residential addresses. In case any of the parties represent a company or an organization, then make sure to include the full name of the organization and its business address too.

Amount of Mortgage

The total actual amount of mortgage must be clearly mentioned in words and numbers in the satisfaction of mortgage form. Additionally, any other amount that is duly paid by the borrower must also be included in the form such as a fee, a deposit, or the amount of interest.

Details of the Subject Property

The form must also include the relevant details of the property undercharge such as the complete address of the property and the tax number of the property.

Declaration Statement

The mortgage satisfaction form must include a clear statement declaring that the mortgage or charge for the subject property or asset has been duly and fully paid by the borrower to the lender.

Details of the Witness

If the mortgaged property is in a state or county where the satisfaction of the mortgage also requires a witness, then make sure to include the relevant details of the witness too like his/her legal name in full, contact details, residential address, etc.

More Satisfaction of Mortgage Forms are Given Below

Sample Mortgage Satisfaction Piece

File Size: 3 KB

Free Editable Satisfaction of Mortgage Property

File Size: 8 KB

Printable Satisfaction of Mortgage Form

File Size: 6 KB

Satisfaction of Mortgage Letter Sample

File Size: 4 KB

Online Satisfaction of Mortgage Form

File Size: 25 KB

Mortgage Certificate and Affidavit of Satisfaction

File Size: 11 KB

Sample Satisfaction of Charge Document

File Size: 57 KB

Satisfaction of Mortgage Form South Carolina

File Size: 3 KB

Sample Satisfaction of Mortgage Form in MS WORD

File Size: 7 KB

Some FAQs About the Satisfaction of Mortgage Form

In order to better understand the importance and purpose of a mortgage satisfaction form, take e look at some FAQs related to the document:

1- Who is the Mortgagor?

A mortgagor is a person to whom the money is given against the charge on his/her asset or property. In other words, a mortgagor is a borrower.

2- Who is the Mortgagee?

A mortgagee is a person who lent the money to the mortgagor against the mortgagor’s asset or property. If the mortgagor fails to pay the full amount to the mortgagee within an agreed time period, the mortgagee will become the owner of the subject property.

3- What is a Notary Public and how to get the mortgage satisfaction form notarized?

The notary public is a state-appointed official who holds the responsibility to authenticate and authorize legal documents like acknowledgments, agreements, deeds, declarations, and other documents, etc. Every state or county in every country has its own notary public.

4- How long does it take to provide a mortgage satisfaction form to the borrower?

The borrower must give the lender a minimum period of a week or two so that he/she can present the satisfaction of mortgage form and thus, release the lien property. However, it may also take a bit longer to actually provide a satisfaction of mortgage form to the borrower due to processing time or anything else.

5- What to do with the document after fulfilling it and getting it authorized by the Notary Public?

Once the document is duly signed by both the parties and also notarized by the notary public, it must be filed with the local land records office of the state or county where your property is located. This office might have different names like County Clerk’s Office, Land Records Office, Land Registry Office, Register of Deeds, or County Recorder’s Office.

6- What are the consequences of not filing or notarizing the satisfaction of mortgage form?

If the satisfaction of the mortgage form is not filed or notarized, penalties may be imposed on both the lender and the borrower. However, the lender is the one who is actually responsible for filing the form and informing the relevant authority while the borrower is only responsible to follow up on the process of release.